AccumulatedDepreciation–Equipment ($75), Salaries Payable ($1,500), UnearnedRevenue ($3,400), Service Revenue ($10,100), and Interest Revenue($140) all have credit final balances in their T-accounts. Thesecredit balances would transfer to the credit column on the adjustedtrial balance. Once all of the adjusting entries have been posted to thegeneral ledger, we are ready to start working on preparing theadjusted trial balance. Preparing an adjusted trial balance is thesixth step in the accounting cycle. An adjusted trialbalance is a list of all accounts in the general ledger,including adjusting entries, which have nonzero balances.

A quick primer on double-entry accounting

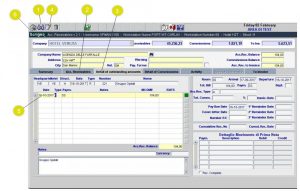

This method is usually used by small companies where only a few adjusting entries are found at the end of the accounting period. In this method, the adjusting entries are directly incorporated into the unadjusted trial balance to convert it to an adjusted trial balance. To get the numbers in these columns, you take the number in the trial balance column and add or subtract any number found in the adjustment column. There is no adjustment in the adjustment columns, so the Cash balance from the unadjusted balance column is transferred over to the adjusted trial balance columns at $24,800. Interest Receivable did not exist in the trial balance information, so the balance in the adjustment column of $140 is transferred over to the adjusted trial balance column.

Its purpose is to ensure that the total amount of Debit Balance in the general ledger is equal to the total amount of Credit Balance in the general ledger. When it comes to the adjustment made, the adjusted trial balance sheet is left with information that is relevant for a particular period as per the information that the business organization seeks. The adjustments made, however, are classified into different categories, which include – deferrals, accruals, missing transactions, and tax adjustments. The second method is simple and fast but is considered less systematic.

How to Calculate Net Income (Formula and Examples)

The preparation of the adjusted trial balance is the sixth step of the accounting cycle. This trial balance is prepared after taking into account all the adjusting entries prepared in the previous step of the accounting cycle. Service Revenue had a $9,500 credit balance in the trial balance column, and a $600 credit balance in the Adjustments column. To get the $10,100 credit balance in the adjusted trial balance column requires adding together both credits in the trial balance and adjustment columns (9,500 + 600). Once all accounts have balances in the adjusted trial balance columns, add the debits and credits to make sure they are equal. If you check the adjusted trial balance for Printing Plus, you will see the same equal balance is present.

In this lesson, we will discuss what an adjusted trial balance is and illustrate how it works. Once all the accounts are posted, you have to check to see whether it is in balance. You could also take the unadjusted trial balance and simply add the adjustments to the accounts that have been changed. In many ways this is faster for smaller companies because very few accounts will need to be altered. Preparing an adjusted trial balance is the fifth step in the accounting cycle and is the last step before financial statements can be produced.

Format and methods of preparing adjusted trial balance

Concepts Statements give the Financial Accounting Standards Board (FASB) a guide to creating accounting principles and consider the limitations of financial statement reporting. For example, Celadon Group misreported revenues over the span of three years and elevated earnings during those years. This gross misreporting misled investors and led to the removal of Celadon Group from the New York Stock Exchange.

There are five sets of columns, each set having a column for debit and credit, for a total of 10 columns. The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. After a company posts its day-to-day journal entries, it can begin transferring that information to the trial balance columns of the 10-column worksheet. The first method is similar to the preparation of an unadjusted trial balance. However, this time the ledger accounts are first updated and adjusted for the end-of-period adjusting entries, and then account balances are listed to prepare the adjusted trial balance. It is usually used by large companies where a lot of adjusting entries are prepared at the end of each accounting period.

5 Prepare Financial Statements Using the Adjusted Trial Balance

However, it is the source a guide to financial leverage document if you are manually compiling financial statements. In the latter case, the adjusted trial balance is critically important – financial statements cannot be constructed without it. Note that only active accounts that will appear on the financial statements must to be listed on the trial balance. If an account has a zero balance, there is no need to list it on the trial balance. The accounts that have been affected because of adjusting entries for the month of December are shown in red font in the adjusted trial balance. It is just for the purpose of explanation, and you don’t need to change the color of account titles in your homework assignments or examination questions.

The account balances are taken from the T-accounts or ledger accounts and listed on the trial balance. Essentially, you are just repeating this process again except now the ledger accounts include the year-end adjusting entries. The preparation of the statement of cash flows, however, requires a lot of additional information. Once all ledger accounts and their balances are recorded, thedebit and credit columns on the adjusted trial balance are totaledto see if the figures in each column match.

- If the organization is using some kind of accounting software, the bookkeeper or accountant just needs to pass the journal entries (including adjusting entries).

- After posting the above entries, the values of some of the items in the unadjusted trial balance will change.

- This net income figure is used to prepare the statement of retained earnings.

- The statement of retained earnings is prepared second to determine the ending retained earnings balance for the period.

- That is because they just started business this month and have no beginning retained earnings balance.

You will not see a similarity between the 10-column worksheet and the balance sheet, because the 10-column worksheet is categorizing all accounts by the type of balance they have, debit or credit. The trial balance information for Printing Plus is shown previously. If we go back and look at the trial balance for Printing Plus, we see that the trial balance shows debits and credits equal to $34,000. For example, IFRS-based financial statements are only required bookkeeping santa clarita to report the current period of information and the information for the prior period. US GAAP has no requirement for reporting prior periods, but the SEC requires that companies present one prior period for the Balance Sheet and three prior periods for the Income Statement.